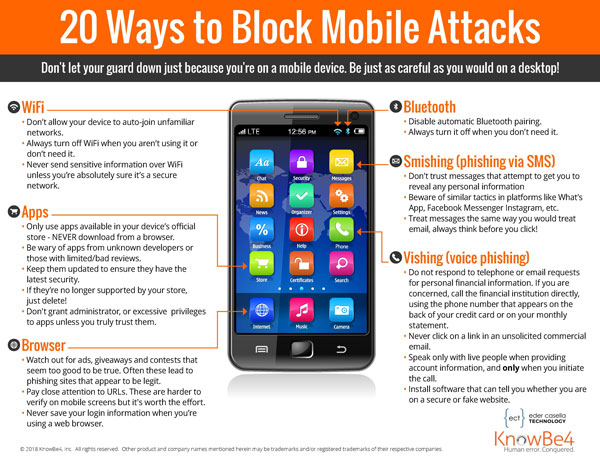

Blocking Mobile Attacks

Mobile security is just as important as the security that you use on your computer. Don’t let your guard down just because you’re on a mobile device. Most of us have a lot of our personal information on our phones—saved passwords, banking information, credit card numbers, and more.

Click here to download a printable version to share with your coworkers and friends.

WiFi

• Don’t allow your device to auto-join unfamiliar networks.

• Always turn off WiFi when you aren’t using it or don’t need it.

• Never send sensitive information over WiFi unless you’re absolutely sure it’s a secure network.

Apps

• Only use apps available in your device’s official store – NEVER download from a browser.

• Be wary of apps from unknown developers or those with limited/bad reviews.

• Keep them updated to ensure they have the latest security.

• If they’re no longer supported by your store, just delete!

• Don’t grant administrator, or excessive privileges to apps unless you truly trust them.

Browser

• Watch out for ads, giveaways, and contests that seem too good to be true. Often these lead to phishing sites that appear to be legit.

• Pay close attention to URLs. These are harder to verify on mobile screens but it’s worth the effort.

• Never save your login information when you’re using a web browser.

Bluetooth

• Disable automatic Bluetooth pairing.

• Always turn it off when you don’t need it.

Smishing (phishing via SMS)

• Don’t trust messages that attempt to get you to reveal any personal information

• Beware of similar tactics in platforms like What’s App, Facebook Messenger Instagram, etc.

• Treat messages the same way you would treat email, always think before you click!

Vishing (voice phishing)

• Do not respond to telephone or email requests for personal financial information. If you are concerned, call the financial institution directly, using the phone number that appears on the back of your credit card or on your monthly statement.

• Never click on a link in an unsolicited commercial email.

• Speak only with live people when providing account information, and only when you initiate the call.

• Install software that can tell you whether you are on a secure or fake website.